Car Donation to Charity – Is It the Right Move?

Car Donation - What You Need to Know

If a charity can directly use your vehicle for transportation or carrying supplies then your car donation is directly benefiting your chosen charitable organization. Unfortunately the majority of charities don’t keep car donations for one reason or another. More times than not, when you donate your car to a charity, they are selling the vehicle and keeping the money.

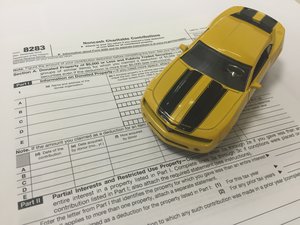

In the past when you wanted to donate a car to charity you could simply deduct the fair market value for your vehicle as published in Kelley Blue Book. That has all changed since the American Jobs Creation Act of 2004. Now the donor of the vehicle is only able to claim a tax deduction for the amount the charity sold the vehicle for. For example, if your vehicle has a Blue Book value of $2,200 but the charity only sells your car for $750, you must submit the lower deduction.

When it comes time to do your taxes make sure you have all the necessary paperwork and proof of donation. One of the most common triggers of an IRS audit is non-cash donations.

Something to consider is selling your car for cash and then donating a portion or all of the money to the charity of your choice. At webuyanycar.com we make selling your vehicle quick and convenient. You can get a used car valuation for your vehicle online in as little as 60 seconds and complete the transaction same-day in about 30 minutes.

Not only is selling to webuyanycar.com a faster process but our highly-trained branch managers will inspect and value your vehicle with you, unlike a charity who removes you from the equation, forcing you to accept the amount they sold it for. At our branch locations, we finalize the paperwork and print you a check on the spot. You can immediately cash or deposit that check and then use that money to make a cash donation.